Why Beverlywood Homeowners Shouldn’t Fear Today’s Mortgage Rates (and Why 2025 Could Be Their Advantage)

Mortgage rates have been the monster under the bed for a while. Every time they tick up, people flinch and say, “Maybe I’ll wait.” But here’s the twist. Waiting for that perfect 5-point-something rate could end up haunting your wallet later.

If you’re a homeowner in Beverlywood, CA, you’ve likely seen the headlines about mortgage rates climbing and wondered if now’s the right time to sell. Many people hesitate, thinking, “Maybe I’ll wait until rates drop.” But here’s the truth: waiting for that perfect rate might cost more than you think, especially if you’re planning to sell in 2025.

Mortgage Rates in Beverlywood 2025: What’s Really Going On

Mortgage rates have hovered around 6.2%–6.4% in late 2025. While that number might sound high compared to the record lows of 2021, it’s far from catastrophic. According to the National Association of Realtors (NAR):

“A 30-year fixed rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households—including 1.6 million renters.”

That means when rates eventually hit that “magic number” likely in 2026, more buyers will jump back into the market, increasing buyer demand and pushing prices higher.

The Math: Why Waiting for 5.99% May Not Pay Off

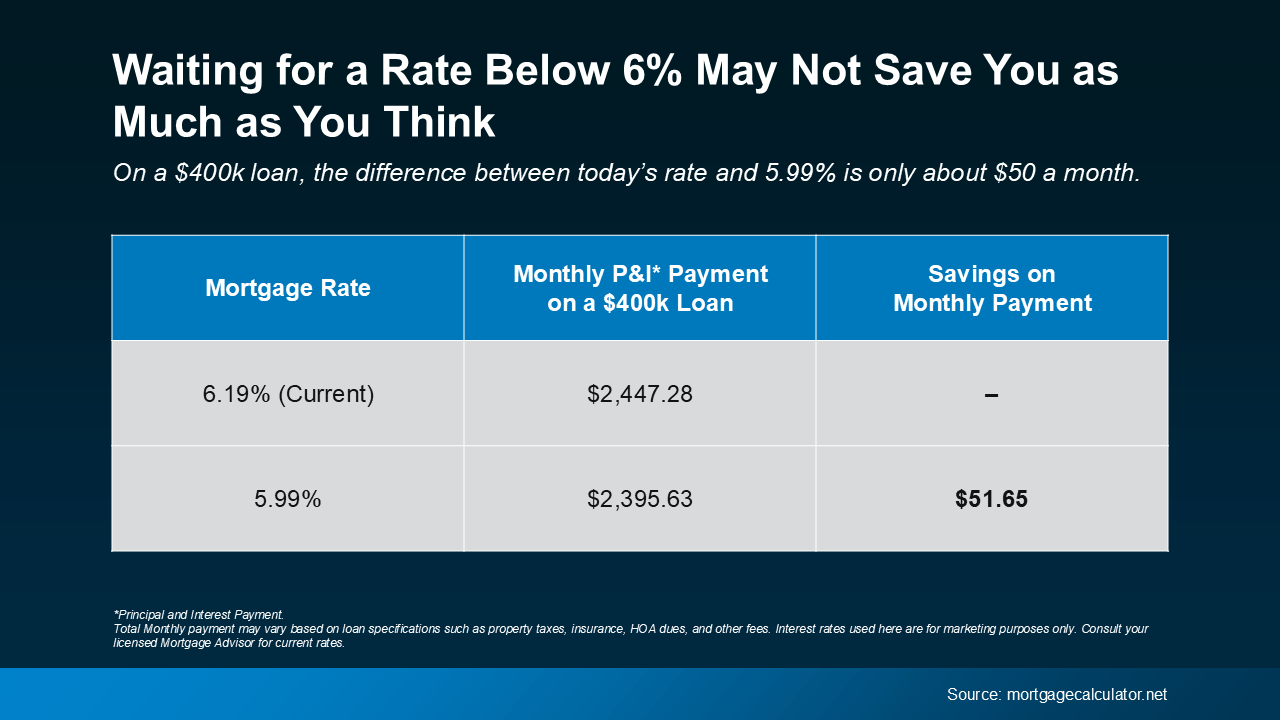

Here’s how the math looks when you run the numbers (see chart below):

Let’s say you’re eyeing a $400,000 mortgage:

At 6.2%, your monthly payment is about $2,450.

At 5.99%, it’s about $2,400.

That’s roughly a $50 monthly difference — less than what many spend on weekly coffee runs or a single DoorDash order. Meanwhile, as rates drop and buyer demand rises, home prices are likely to climb, potentially offsetting any monthly savings.

What It Means for Beverlywood Homeowners: Even if rates dip slightly, price increases will likely cancel out those savings. Acting before the market heats up could put you in a stronger selling position.

Why Acting Now Benefits Beverlywood Home Sellers

1. Strong Property Values in Beverlywood

The median home value in Beverlywood sits around $2.2 million, with active listings averaging $2.7 – $3.4 million.

Even as rates rise, buyer interest remains high for this prestigious Westside Los Angeles neighborhood.

2. Buyer Psychology Will Shift Quickly

Once rates dip below 6%, buyers who have been “waiting it out” will re-enter the market. That means more competition for buyers and fewer negotiation advantages for sellers.

3. Limited Inventory Creates Opportunity

Even with slightly higher rates, low housing supply in Beverlywood gives sellers leverage. You can capture motivated buyers before inventory climbs again next spring.

Local Insights: What Beverlywood Homeowners Should Know

Market Snapshot (Q4 2025):

- Median home price: ~$2.8 million

- Median days on market: 22 days

- Active inventory: Moderate but climbing

- Buyer interest: Strong among move-up buyers and families

This mix suggests a balanced yet competitive market, meaning sellers can still negotiate favorable deals while buyers have slightly more breathing room.

What Industry Experts Say

Jessica Lautz, Deputy Chief Economist at NAR, says:

“Over the last 5 weeks, mortgage rates have averaged 6.31%. This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices.”

Matt Vernon, Head of Retail Lending at Bank of America, adds:

“Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation… it could be the right chance to make a move.”

For home sellers Beverlywood, this means one thing: buyers are looking now, not later.

Steps to Take Before Listing Your Beverlywood Home

Schedule a Home Valuation. Understand your property’s current market value.

Enhance Curb Appeal. Small exterior updates can yield high ROI.

Stage Strategically. Beverlywood buyers expect polished, move-in-ready homes.

Review Comparable Sales. See how homes similar to yours performed recently.

Partner with a Local Expert. A Beverlywood-based agent understands micro-market pricing, school zones, and buyer demographics.

The Bottom Line

Mortgage rates aren’t waiting, and neither should you when it comes to listing your Beverlywood home. A small rate drop won’t offset the price increases that follow. By listing now, you’re positioning yourself ahead of the wave of returning buyers.

Whether you’re upsizing, downsizing, or cashing in on long-term equity, today’s market conditions favor sellers who act strategically.

Ready to explore what your Beverlywood home is worth?

Contact Naomi Selick today for a complimentary home valuation and personalized selling strategy.